Economic forecast

Industry experts predict economic trends of the coming years at UD conference

12:06 p.m., Feb. 13, 2015--Last week the University of Delaware held the 10th annual Economics Forecast, featuring business and economics experts with a variety of perspectives.

UD’s Center for Economic Education and Entrepreneurship (CEEE) in the Alfred Lerner College of Business and Economics partnered with Lyons Companies to present the conference, which featured three presentations and a panel discussion.

People Stories

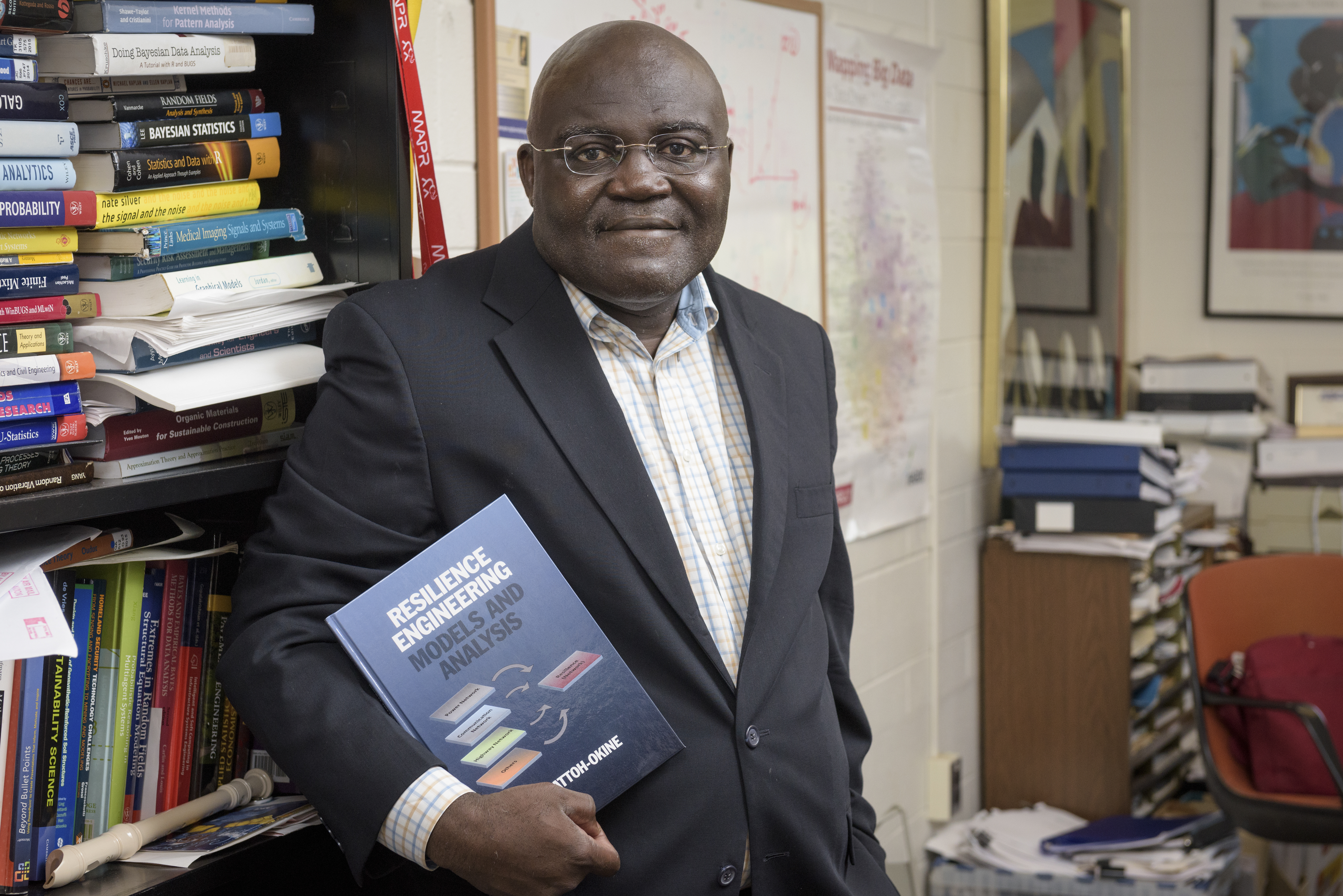

'Resilience Engineering'

Reviresco June run

The first speaker of the morning was Michael Farr, CNBC contributor, president of Farr, Miller and Washington, LLC and author of The Arrogance Cycle.

Farr utilized the conference’s interactive audience response program throughout his presentation. Audience members used small remote controllers to answer his questions on topics like their comfort level with stock performance.

While audience response was markedly positive, Farr warned of becoming too complacent during times of economic recovery.

“In literature, tragedies always begin on sunny days,” Farr said, reading from The Arrogance Cycle. Feeling like “you can’t lose,” he continued, can lead to poor decision-making.

“When you think everything is fine, you have to ignore a lot of things,” Farr said.

This includes the national debt, which continues to rise despite growing Gross Domestic Product.

Another “elephant in the room,” Farr said, lies in the average American’s inability to adequately save for retirement.

“The labor market, I believe, is weaker than the headlines,” Farr said. “The middle class continues to get squeezed by stagnant incomes and rising costs.”

Farr explained that in 2013 the median household income, adjusted for inflation, was comparable to the average income in 1996. Meanwhile, the costs of health care, education, food and housing have continued to rise.

“Think about the money that’s out there in people’s hands available to spend, and also think about who has it,” Farr said. “If the consumer represents two-thirds of the economy, how much gas does the consumer have in the tank to drive the engine of the economy?”

“Consumer spending is going to face ongoing headwinds,” Farr continued. “The jobs that we’ve created are not really high-quality jobs.”

However, Farr sees reasons for optimism, including positive demographic trends like an increasingly educated population.

“When you are buying stocks you are buying a long-term call on the future of America,” Farr said. “Don’t bet against this country.”

Discussing not just America but other countries as well was the conference’s second speaker, Jay Bryson, managing director and global economist for Wells Fargo. Bryson provided a global economic outlook for what he calls, “an interconnected world.”

Jon Hilsenrath, chief economic correspondent for The Wall Street Journal and the conference’s moderator, cautioned the audience to listen carefully to Bryson because, “some of most important developments happening in the global economy are happening outside of the U.S.”

Bryson said that he was optimistic about the Eurozone’s growth as the region begins to accelerate out of its recession, but only modestly so.

“We do believe that Europe is going to continue to recover going forward, but they’re not back to normal growth yet,” Bryson said.

Meanwhile, Bryson said it might be unlikely that China can continue the unprecedented economic growth it has seen in recent years, although any market crash could likely be offset through governmental measures.

Despite the potential effect of slow international growth on the domestic economy, Bryson also spoke positively about growth within the United States. He noted that three million jobs were created last year, making it the strongest year since 1999.

In fact, Bryson called the current attitude of the business community more optimistic than he has seen since 2007.

Also a topic of discussion was the recent drop in gas prices, which Bryson explained will help push consumer spending higher in 2015.

“People in the lowest income quintile spent roughly 12 percent of their after-tax income on gasoline last year,” Bryson said. “If gasoline prices remain where they are for the rest of the year, they will only spend 8 percent. That’s a 4 percent tax cut and is huge.”

However, Bryson cautions that the decline in oil prices is a one-time phenomenon and, in the long term, will likely not lower inflation rates.

Further, in response to a question posed by a Delaware Military Academy student about alternative energy sources, Bryson said that the drop in gas prices could weaken interest for renewable energy innovation.

“Alternative sources of energy make a lot more sense when oil is at $100 a barrel than when it is at $50 a barrel,” Bryson said. “So the collapse in oil prices over the last few months may actually dampen some of those explorations, at least over the next few years.”

The conference’s final speaker was James A. Bullard, president and CEO of the Federal Reserve Bank of St. Louis.

Bullard shared the cautious optimism of his fellow conference speakers.

“I do think there’s considerable momentum in the U.S. economy,” Bullard said. “I think that’s likely to continue into 2015 because I think there are important tailwinds for the U.S. economy.”

“The two important tailwinds that are supporting the momentum effects in the U.S. economy are lower long-term interest rates in the U.S. and lower global oil prices,” Bullard continued.

However, while low long-term interest rates support the current growth of the U.S. economy, Bullard discussed the folly of instating zero percent interest rates during times of modest growth.

Bullard and his fellow panel members discussed the Federal Reserve’s use of the word “patient” in their decisions of when to raise these rates, and whether the word inhibits flexibility.

“The economy has normalized a lot, and we can no longer rationalize the ZIRP — the zero interest rate policy,” Bullard said. “We can rationalize low interest rates. We can’t rationalize zero interest rates.”

Presentation of James B. O’Neill Award

Also presented at the conference was the James B. O’Neill Award for Excellence in Economic Education and Entrepreneurship. This year’s recipient was Don Puglisi, MBNA America Professor Emeritus of Business at UD and managing director of Puglisi and Associates, which he founded in 1973.

“This award is very special to me,” Puglisi said, discussing his relationship with O’Neill, the CEEE’s former longtime director.

“When Jim and I came to UD, at first it was a job,” Puglisi said. “The job became a career and the career, for both of us, has become a lifetime commitment. UD has really been our home for over 30 years.”

Puglisi called the CEEE “the preeminent center of its kind in the United States” and discussed some of its most impactful projects.

“Through the center we’ve been able to bring to life Jim’s true belief in the power of the teacher,” Puglisi said. “By training teachers throughout the state of Delaware, we’ve been able to extend the reach of economic education and financial literacy from northern New Castle County to the bottom of Sussex County.”

Puglisi said that he looks forward to continuing his work with Carlos Asarta, the CEEE’s current director, as the need for economics education continues to grow in complexity and scope.

“I have no doubt that Carlos and the CEEE, with the support of the Delaware Council on Economic Education, are up to meeting that challenge,” Puglisi said. “I look forward to joining them on that adventure.”

Article by Sunny Rosen

Photos by Ambre Alexander Payne