Financial crisis implications

Hutchinson Lecture features Federal Reserve Bank expert Wascher

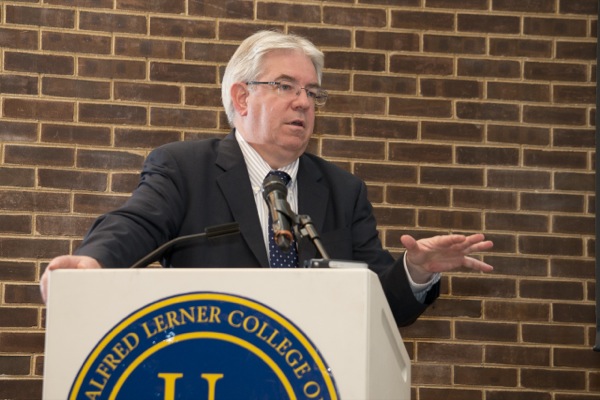

2:50 p.m., May 15, 2014--The student became the teacher at last week’s 24th annual Hutchinson Lecture in macroeconomics when Federal Reserve System expert William L. Wascher delivered a presentation named for the late Harry D. Hutchinson, a professor of economics who taught at the University of Delaware from 1959-89.

Hutchinson taught macroeconomics and money and banking to generations of UD students.

People Stories

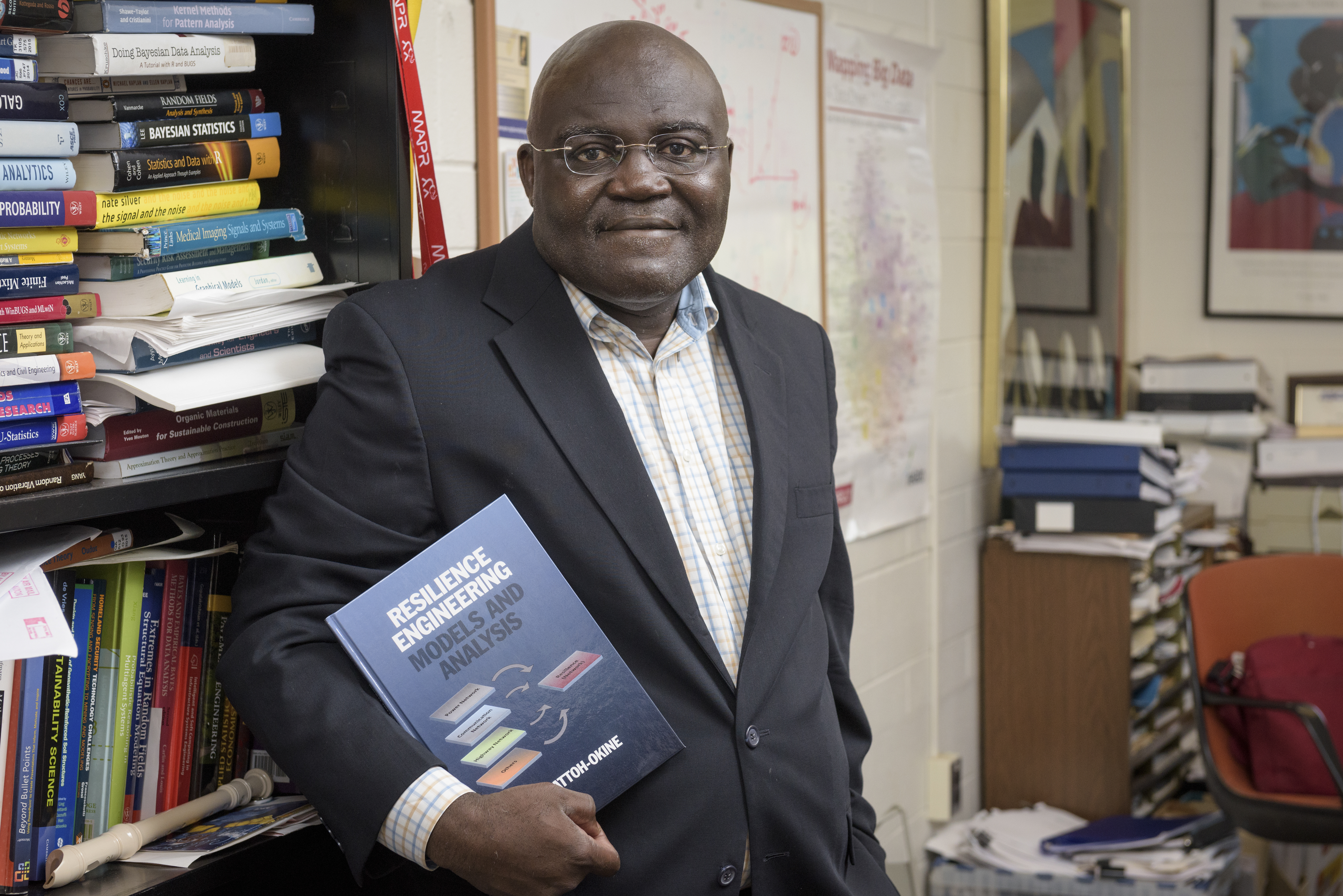

'Resilience Engineering'

Reviresco June run

“The collapse of the housing market bubble has led to the biggest drop in GDP and the largest unemployment rate since the Depression,” said Wascher, who graduated with degrees in economics and mathematics from UD in 1978 and has served as an economist with the Board of the Governors of the Federal Reserve System since 1983. “Recovery has been very slow.”

So how should policymakers respond to economic crises? Was there permanent damage to our economy? These questions – and the implications for policymakers – are what Wascher addressed during the Hutchinson Lecture, which is sponsored by the Department of Economics and the Department of Finance in the Alfred Lerner College of Business and Economics and designed to address a topic of current interest in banking and/or finance.

Wascher, who is known for his work on minimum wages and aggregate supply, explained that when estimating the economic damage, three mechanisms cause weakness in aggregate supply: reduced labor input due to the high level of long-term unemployment; weak sales that discourage research and development spending; and capital deepening, where overall the economy expands and productivity per worker increases.

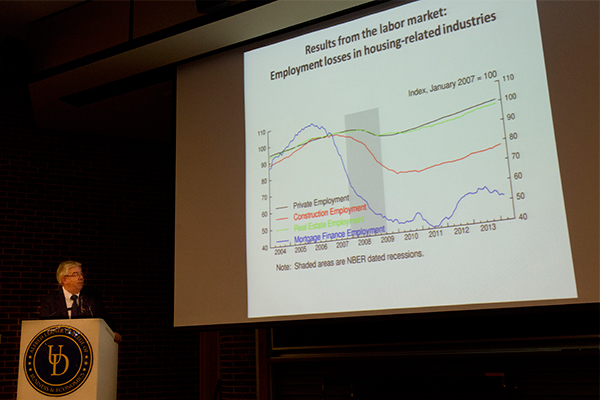

Using a graph, he showed the audience that a steep decline in capital accumulation and slower economic growth since 2007 have put potential GDP at about seven percent below the trajectory it was on prior to the recession.

“Monetary policies should be more aggressive when fighting downturns in the economy,” said Wascher, who also suggested examining employment data for more information.

“The Labor Department has compiled comprehensive employment data, which is a natural place to look for structural damage,” said Wascher. “The data indicate that mortgage finance and real estate employment decreased in 2008-09 and they have not recovered. Some companies are not rehiring lost workers. Some are closing permanently. Research on these displaced workers indicates there are longer downtimes between jobs than ever before.”

According to Wascher, many long-term unemployed people find that employers are more discriminating when rehiring, which did not happen in the 1982 recession. He identified problems that the unemployed face today, including a decrease in skill levels, lost relationships with colleagues who previously would have helped them and the stigma associated with being unemployed for a lengthy time.

“We feel that we may have lost a generation of new firms and also a generation of people who have given up on getting a job,” said Wascher.

So how can policymakers have an impact?

“Significant damage to the supply side of the economy was endogenous to the weakness in aggregate demand — contrary to the traditional view that policymakers should accommodate aggregate supply conditions,” said Wascher. More aggressive monetary and fiscal responses to the crisis might have further mitigated the damage.

He concluded that the evidence still shows minimum wages pose a tradeoff of higher wages for some against job losses for others, and that policymakers need to bear this tradeoff in mind when making decisions about increasing the minimum wage.

Ask the expert

A question-and-answer session concluded the event and tapped into Wascher’s expertise. When asked about the plight of laid-off people, Wascher said that it varies.

“Some people may decide to retire earlier than they otherwise would have instead of continuing to look for another job,” said Wascher. “Many return to school to improve their skills and enter a new field. Some may go on disability — even in their 50s.”

One audience member commented on the extreme distortion of the markets; in response, Wascher talked about how companies may have pulled back on investments since the financial crisis.

“The Federal Reserve is improving communications, but the economic recovery has been extremely slow,” said Wascher. “We’re worried that the state of economic recovery will be persistently slow for quite a period of time.”

As for a global picture, some wondered whether the U.S. is now relying on the technology of other nations and not generating its own developments.

“There is a global slowdown, where new technological developments are not being generated worldwide, including in the U.S.,” said Wascher.

About Wascher

Wascher has been an economist with the Board of Governors of the Federal Reserve System since 1983. He was a visiting economist at the Bank for International Settlements, Basel, Switzerland, in 1998-99, and a senior staff economist at Council of Economic Advisors, Executive Office of the President, 1989-90.

Wascher received his bachelor’s degree from UD in economics and mathematics in 1978, and his master’s and doctoral degrees from the University of Pennsylvania in 1980 and 1983, respectively.

Article by Terry Hartel

Photos by Lane McLaughlin