ADVERTISEMENT

- Rozovsky wins prestigious NSF Early Career Award

- UD students meet alumni, experience 'closing bell' at NYSE

- Newark Police seek assistance in identifying suspects in robbery

- Rivlin says bipartisan budget action, stronger budget rules key to reversing debt

- Stink bugs shouldn't pose problem until late summer

- Gao to honor Placido Domingo in Washington performance

- Adopt-A-Highway project keeps Lewes road clean

- WVUD's Radiothon fundraiser runs April 1-10

- W.D. Snodgrass Symposium to honor Pulitzer winner

- New guide helps cancer patients manage symptoms

- UD in the News, March 25, 2011

- For the Record, March 25, 2011

- Public opinion expert discusses world views of U.S. in Global Agenda series

- Congressional delegation, dean laud Center for Community Research and Service program

- Center for Political Communication sets symposium on politics, entertainment

- Students work to raise funds, awareness of domestic violence

- Equestrian team wins regional championship in Western riding

- Markell, Harker stress importance of agriculture to Delaware's economy

- Carol A. Ammon MBA Case Competition winners announced

- Prof presents blood-clotting studies at Gordon Research Conference

- Sexual Assault Awareness Month events, programs announced

- Stay connected with Sea Grant, CEOE e-newsletter

- A message to UD regarding the tragedy in Japan

- More News >>

- March 31-May 14: REP stages Neil Simon's 'The Good Doctor'

- April 2: Newark plans annual 'wine and dine'

- April 5: Expert perspective on U.S. health care

- April 5: Comedian Ace Guillen to visit Scrounge

- April 6, May 4: School of Nursing sponsors research lecture series

- April 6-May 4: Confucius Institute presents Chinese Film Series on Wednesdays

- April 6: IPCC's Pachauri to discuss sustainable development in DENIN Dialogue Series

- April 7: 'WVUDstock' radiothon concert announced

- April 8: English Language Institute presents 'Arts in Translation'

- April 9: Green and Healthy Living Expo planned at The Bob

- April 9: Center for Political Communication to host Onion editor

- April 10: Alumni Easter Egg-stravaganza planned

- April 11: CDS session to focus on visual assistive technologies

- April 12: T.J. Stiles to speak at UDLA annual dinner

- April 15, 16: Annual UD push lawnmower tune-up scheduled

- April 15, 16: Master Players series presents iMusic 4, China Magpie

- April 15, 16: Delaware Symphony, UD chorus to perform Mahler work

- April 18: Former NFL Coach Bill Cowher featured in UD Speaks

- April 21-24: Sesame Street Live brings Elmo and friends to The Bob

- April 30: Save the date for Ag Day 2011 at UD

- April 30: Symposium to consider 'Frontiers at the Chemistry-Biology Interface'

- April 30-May 1: Relay for Life set at Delaware Field House

- May 4: Delaware Membrane Protein Symposium announced

- May 5: Northwestern University's Leon Keer to deliver Kerr lecture

- May 7: Women's volleyball team to host second annual Spring Fling

- Through May 3: SPPA announces speakers for 10th annual lecture series

- Through May 4: Global Agenda sees U.S. through others' eyes; World Bank president to speak

- Through May 4: 'Research on Race, Ethnicity, Culture' topic of series

- Through May 9: Black American Studies announces lecture series

- Through May 11: 'Challenges in Jewish Culture' lecture series announced

- Through May 11: Area Studies research featured in speaker series

- Through June 5: 'Andy Warhol: Behind the Camera' on view in Old College Gallery

- Through July 15: 'Bodyscapes' on view at Mechanical Hall Gallery

- More What's Happening >>

- UD calendar >>

- Middle States evaluation team on campus April 5

- Phipps named HR Liaison of the Quarter

- Senior wins iPad for participating in assessment study

- April 19: Procurement Services schedules information sessions

- UD Bookstore announces spring break hours

- HealthyU Wellness Program encourages employees to 'Step into Spring'

- April 8-29: Faculty roundtable series considers student engagement

- GRE is changing; learn more at April 15 info session

- April 30: UD Evening with Blue Rocks set for employees

- Morris Library to be open 24/7 during final exams

- More Campus FYI >>

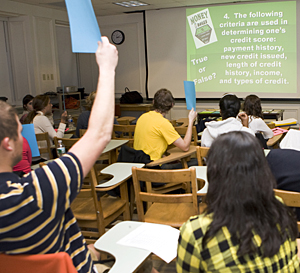

1:25 p.m., Nov. 25, 2009----Twenty-one freshmen enrolled in a University of Delaware First Year Experience (FYE) personal finance course, "The Most Important Grade You Ever Earn," received sobering advice about responsible use of credit cards during a presentation by two officials from Bank of America on Thursday, Nov. 19.

The presentation by Lisa Thornton, senior vice president and business support executive, and Connie Montana, assistant vice president and corporate social responsibility project manager, started with a video clip from Saturday Night Live, "Don't Buy Stuff You Can't Afford," which emphasized saving for purchases instead of running up credit card debt.

"You will be graded throughout your life; you will be graded once a month from a credit perspective," Thornton told the students.

All first-year students at UD participate in the FYE program, designed to help them succeed academically and socially in their first year at the University. All incoming bachelor and associate degree undergraduate students are required to register and successfully complete at least one FYE course.

Transfer students who registered and successfully completed at least one semester at another college or university are exempt, but certain first year seminars are required in the curriculum of particular majors regardless of transfer credits.

The lesson, which was taken by more than 20 different freshman classes during the semester, was presented by UD's Center for Economic Education and Entrepreneurship (CEEE).

During the presentation, the students participated in a true or false quiz that covered key points about credit card debt, including the fact that making minimum payments of $10 for an $800 purchase with annual interest of 18 percent would pay off the debt in 14 years and nine months with total payments of $2,034.

"Consumer credit was originally used to purchase expensive items. Good debt is that used for durables, such as furniture, appliances or education," Thornton said. "If you wear it, eat it or drink it, don't use a credit card to buy it."

Jill Leabman, a cognitive science major from West Hartford, Conn., said the lesson gave her very useful information.

"I didn't know all those things before. Nobody talked to me about all that; I learned something," Leabman said. "What I learned most about is whether to choose between paying for something up front or paying minimum payments every month."

Norma Gaines-Hanks, associate professor of human development and family studies, said many first year students -- and perhaps most college students -- do not recognize how easy it is to make uninformed financial decisions that can impact them long after they have left college.

"The example of the person buying an $800 stereo and paying the minimum due each month was eye-opening," Gaines-Hanks said. "If nothing else, I think when considering a big ticket purchase, the students will either save some money first or at least pay more than the minimum due. That's a lesson from which we can all benefit, regardless of our age."

Article by Martin A Mbugua

Photos by Ambre Alexander